Merchant Cash Advance: Explained

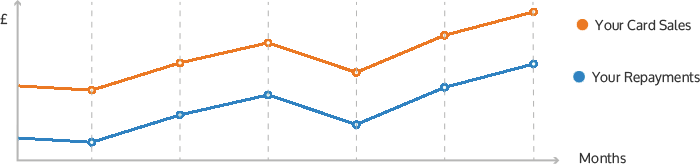

A Merchant Cash Advance is an unsecured funding option that is designed to mirror your business activity or turnover. The Repayment process is linked to your card sales offering a flexible option for all businesses. All business experience highs and lows throughout the year but traditional bank loans don’t. They offer a fixed monthly payment regardless of how the business is performing. Business Cash Advances approach things differently.

The amount you can borrow is linked or calculated to you averag monthly card turnover. We can offer up to 125% of this amount. A percentage is agreed amd will be repaid automatically until the balance is cleared. A business cash advance puts the business in control and removes the pressure of the traditional loan.

How does a Merchant Cash Advance work?

Business cash advances are a quick and easy way to raise between £2,500 and £200,000 for your business. Unlike a regular loan, there are no fixed weekly or monthly payments. You simply pay back a small percentage of your credit and debit card sales, which means that you only pay us back when you sell to your customers.

So if you’re having a quiet month, your repayments automatically reduce, which helps you manage your cash flow.

There is an all-inclusive cost that gets added to the cash advance, so there are no interest charges, APR’s or late fees.

- Apply in minutes

- 90% approval rate

- Approval within 48 hours

- No security or business plans required

- Flexible repayments based on your card sales

- One simple all inclusive cost, that never changes, agreed upfront.

Key benefits of a business cash advance?

SIMPLE APPLICATION PROCESS, 90% APPROVAL RATE

Most applications are approved within 24 – 48 hours.

RAISE BETWEEN £2,500 AND £200,000

Flexible funding available with repayments that mirror your monthly card sales.

NO FIXED TERM OR SET MONTHLY PAYMENTS

Repayments mirror your credit and debit card sales.

NO SECURITY OR BUSINESS PLAN REQUIRED

Unsecured, fast and flexible funding. No unnecessary paperwork required.

DEDICATED RELATIONSHIP MANAGER

Enjoy the benefits of a dedicated funding specialist.

NO ADMIN FEES OR HIDDEN EXTRAS

A funding partner with no admin fees, APR’s or hidden unwanted surprises.

PAYBACK WHEN YOU SELL

Only repay when you sell to customers.

ONE SIMPLE ALL-INCLUSIVE COST

Fixed total repayment amount.

Am I eligible?

Our minimum requirements for eligibility on a merchant cash advance are that:

- You have been in business for at least 6 months;

- Your average credit and/or debit cards sales during this period are at least £2,500 per month.

Contact our customer services team to find out more.

Want to find out more?

Follow the link and fill in the form and we will get in touch to discuss your requirements further.